Brief overview

This situation consists of planning the grocery shopping for a four-person family for two days. As a result of this activity, the students will be learn about how to follow a budget, and about taxable and non-taxable food items.

Subject area(s)

Mathematics

• Competency 1: Solve a situational problem

Analysis of the situation, appropriate organization and use of concepts and strategies

Explanation of the teaching goal

– Following a budget

– Awareness of taxable and non-taxable food items

Expected outcomes

Ensure that the students understand that certain choices allow them to save money. Using taxable and non-taxable food items, the students will be able to recognize price differences and will understand how to follow a pre-established budget.

Role-playing

Role-playing can be done by having the teacher ask a series of questions about grocery shopping:

– Have you ever gone grocery shopping?

– Have you ever noticed that taxes have to be added to certain products at the grocery store?

– What products are taxable at the grocery store?

– What is the difference between a taxable and a non-taxable product?

Achievement

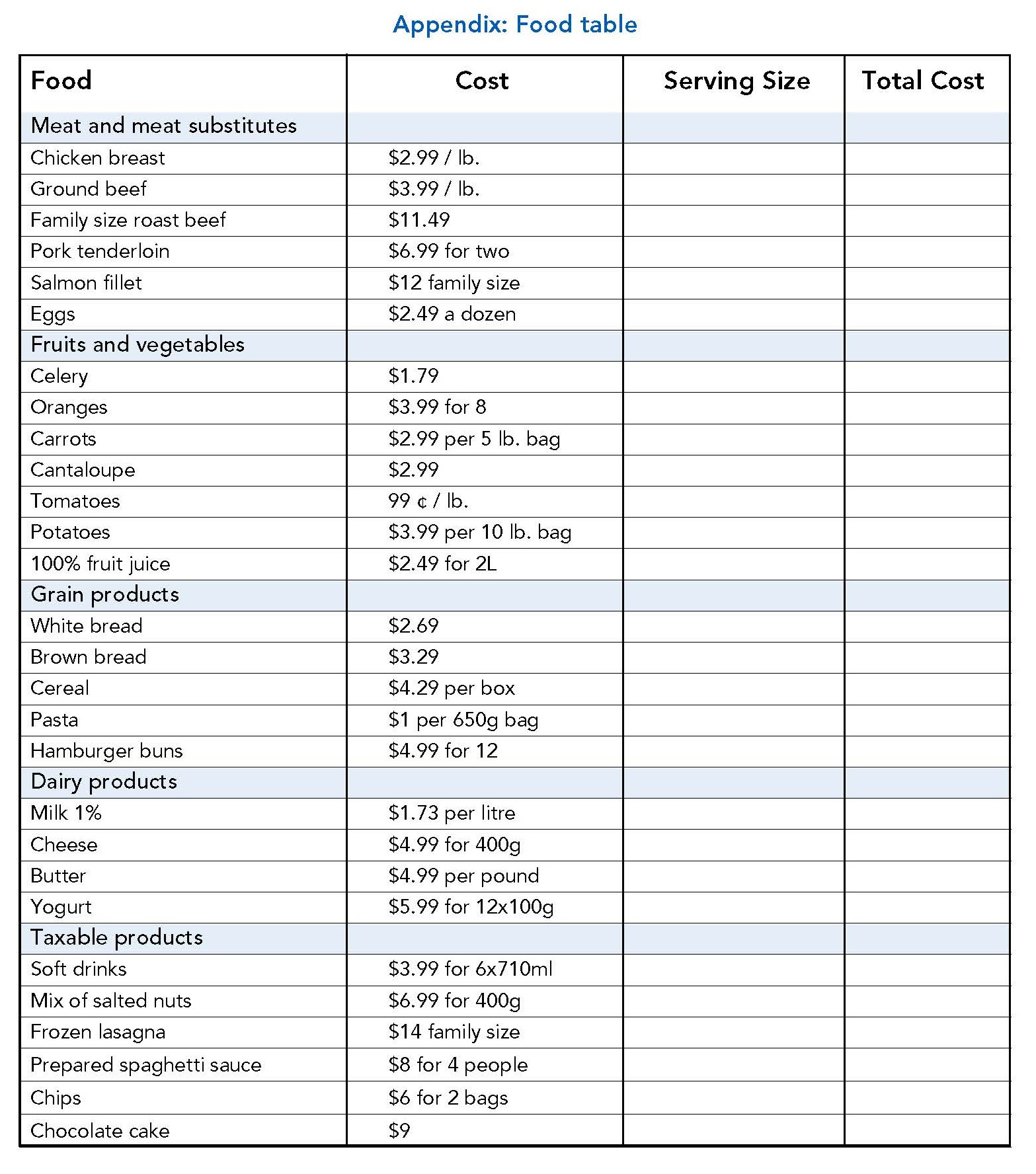

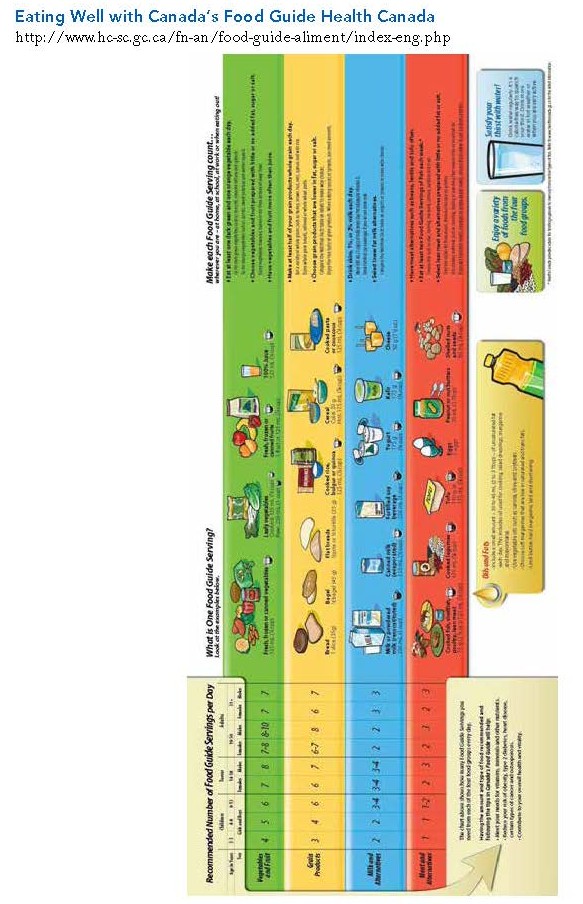

Students must plan menus for a four-person family by filling out the table in the appendix. They should buy enough food to last two days, taking into consideration as much as possible the recommendations of Canada’s Food Guide. A table with various grocery products is available in the appendix to make this task easier, and to allow students to make the necessary calculations.

*The teacher may also choose to ask the students to use grocery store flyers.

Reinvestment

Hand out copies of the following list of taxable and non taxable foods and beverages or access the list online at: https://www.revenuquebec.ca/en/businesses/consumption-taxes/gsthst-and-qst/special-cases-gsthst-and-qst/food-services/grocery-and-convenience-stores/

Taxable foods and beverages (Excerpt from Revenu Quebec)

- all dispensed beverages

- beer, wine and alcoholic beverages

- candies and other confections

- carbonated beverages

- carbonated mineral water

- chewing gum

- chocolate bars

- foods heated for consumption (French fries, burritos, pizzas, chicken, etc.)

- fruits, seeds, nuts and popcorn when they are coated or treated with candy, chocolate, honey, molasses, sugar, syrup or artificial sweeteners

- granola bars

- hot beverages (coffee, tea, etc.)

- ice cream, ice milk, frozen yogurt, frozen juice bars

- ice pops

- popped corn products

- potato chips, corn chips and similar products

- salted seeds

- single servings of all beverages other than plain milk and beverages prepared and prepackaged specially for consumption by babies

- single servings of sweetened baked goods (for example, purchases of fewer than six doughnuts, muffins, slices of cake or pie, etc.)

Other taxable items

Examples of other taxable items are:

- charcoal and barbecue products

- deodorants and perfumes

- first aid products

- hair care products

- household cleaning products (scouring pads, fabric softeners, etc.)

- housewares and kitchenware

- newspapers, magazines, greeting cards

- non-prescription medications

- paper products (paper towels, toilet paper, etc.)

- personal hygiene products

- pet food and pet products

- plants and gardening supplies

- school and stationery supplies

- shaving products

- skin care products

- soaps and detergents

- toys

Zero-rated basic groceries

Examples of zero-rated basic groceries are:

- breads and cereals

- dairy products (unflavoured milk, cheese, butter, cream, sour cream, yogurt)

- eggs

- fish

- fruits

- meat (beef, poultry, pork, lamb, prepared meats, sausages)

- vegetables

The teacher encourages the students to share their comments.

Provision

No special provisions are required. However, it would be beneficial to display or present Canada’s Food Guide in the classroom.

Required material

– Appendix: Student file

– Appendix: Food table

– Pencils

Optional:

– Grocery store flyers

– Canada’s Food Guide (available for free on the website https://food-guide.canada.ca/en/)

Evaluation tracks

Mathematics: evaluation of the ability to understand a situation, to use the appropriate knowledge, to follow steps to arrive at a solution (C. 1)

*The teacher is free to adapt each section based on the group and as the situation unfolds.

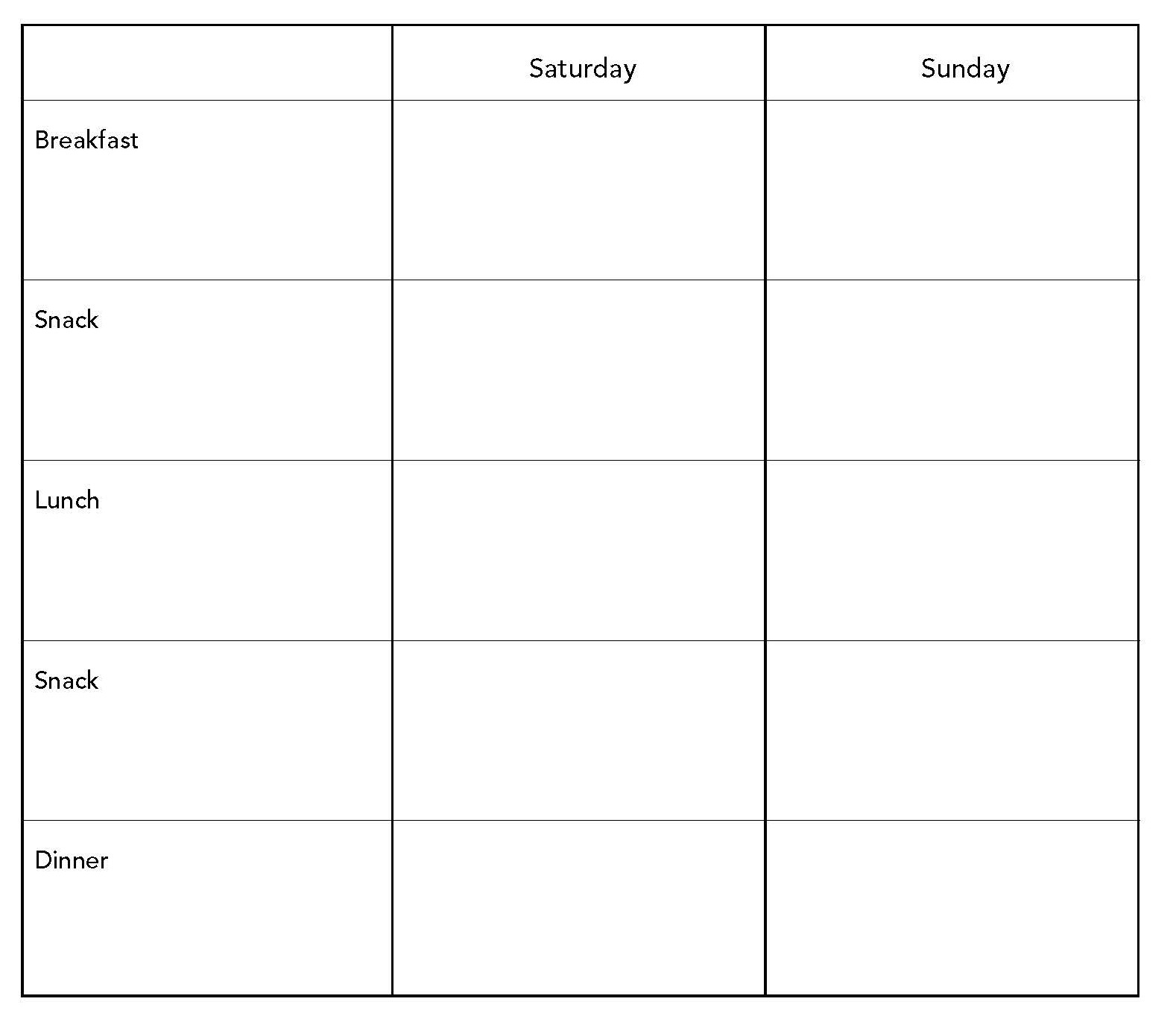

Appendix: Student file

Your parents ask you to help with the grocery shopping for the weekend. Therefore, you must plan meals for your four-person family. Careful! You should plan to buy food for two days, following as best you can the recommended servings of Canada’s Food Guide.

Your family is made up of your two parents, aged 40, your little 8-year-old sister, and you. You should follow a maximum budget of $100. Use the food table to help you choose the menus and calculate your total grocery bill. Of course, you can use the basic foods that your parents already have, such as flour, spices, ketchup, mayonnaise, etc.

Fill out the following table to determine the meals for each day.